45 how to calculate a bond's coupon rate

Calculate the Coupon Rate of a Bond - YouTube 33,837 views Jul 25, 2018 This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond... Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity.

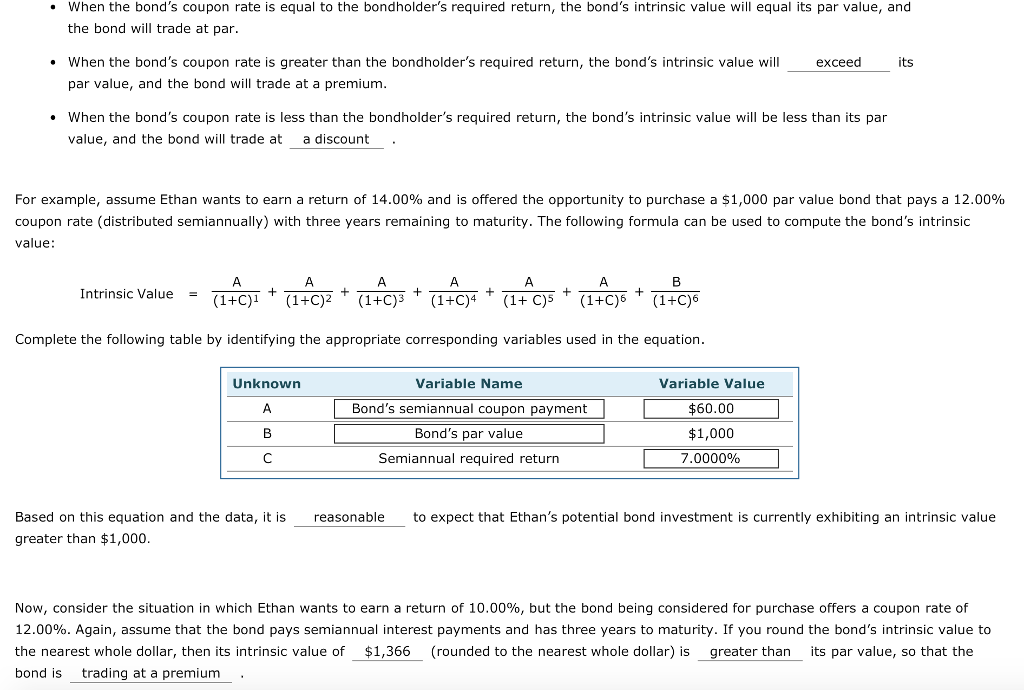

How to Calculate the Price of a Bond With Semiannual Coupon Interest ... To convert this to a coupon payment, or the amount of money you'd actually receive each period, multiply the face amount of the bond by the required rate of return. Continuing with the example, if the face value was $1,000, you'd multiply it by 0.025. This results in a semiannual payment of $25. Discounting Future Payment to Present Values

How to calculate a bond's coupon rate

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 How to Calculate Bond Discount Rate: 14 Steps (with Pictures) - wikiHow Calculate the bond discount rate. This tells your the percentage, or rate, at which you are discounting the bond. Divide the amount of the discount by the face value of the bond. Using the above example, divide $36,798 by $500,000. The discount rate for the bond is 7.36 percent. 5 Compare the calculated discounted bond value with the market price. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

How to calculate a bond's coupon rate. Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a... What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example,... How to Calculate Bond Price on Ba Ii Plus The higher the interest rate, the more you will be paid back in interest over time. The Bond Price Calculator can help you determine how much your bonds are worth based on current market conditions. Simply enter in the bond's coupon rate, its maturity date, and its face value. The calculator will then return the current price of the bond. Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency. What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. How to Calculate Bond Price in Excel (4 Simple Ways) Method 1: Using Coupon Bond Price Formula to Calculate Bond Price Users can calculate the bond price using the Present Value Method ( PV ). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is Bond Pricing - Formula, How to Calculate a Bond's Price Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. Zero-coupon bonds are typically priced lower than bonds with coupons. Bond Pricing: Principal/Par Value

What Is a Coupon Rate? How To Calculate Them & What They're Used For Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder.

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay ...

how to calculate bond yield to maturity in excel? The bond yield formula is used to calculate the yield of a bond. The formula is: Yield = (Coupon rate x Par value) / Price of bond Where: Coupon rate is the interest rate paid by the issuer Par value is the face value of the bond Price of bond is the price at which the bond is currently trading in the market

How To Find Coupon Rate Of A Bond On Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator.

Bond Yield Calculator The equations that the algorithm is based on are: Current bond yield = Annual interest payment / Bond's current clean price. Annual interest payment = Bond's face value * Bond's coupon rate (interest rate) * 0.01. Please remember that the coupon rate is in decimal format thus it should be multiplied with 0.01 to convert it from percent.

How is the coupon rate of a bond calculated? - Quora Answer (1 of 3): The coupon rate is fixed when the bond is issued. It never changes. The term "coupon" is an old-fashioned term dating back to when borrowers —- Governments or Companies—- actually issued paper, bearer bonds. You'd lend the US Treasury $1000, and they would hand you an IOU with c...

Coupon Rate Formula & Calculation - Study.com Examples of How to Calculate Coupon Rate. Company ABZ is raising capital for its new project by issuing bonds in the capital market. The company is issuing 20,000 bonds at $1,000 par value that ...

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon (C) is calculated using the Formula given below. C = Annual Coupon Rate * F C = 5% * $1000 C = $50 Coupon Bond is calculated using the Formula given below. Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $50 * [1 - (1 + 6%/1) -1*9] + [$1000 / (1 + 6%/1) 1*9 Coupon Bond = $932

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

How to Calculate Bond Discount Rate: 14 Steps (with Pictures) - wikiHow Calculate the bond discount rate. This tells your the percentage, or rate, at which you are discounting the bond. Divide the amount of the discount by the face value of the bond. Using the above example, divide $36,798 by $500,000. The discount rate for the bond is 7.36 percent. 5 Compare the calculated discounted bond value with the market price.

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "45 how to calculate a bond's coupon rate"