44 zero coupon convertible bond

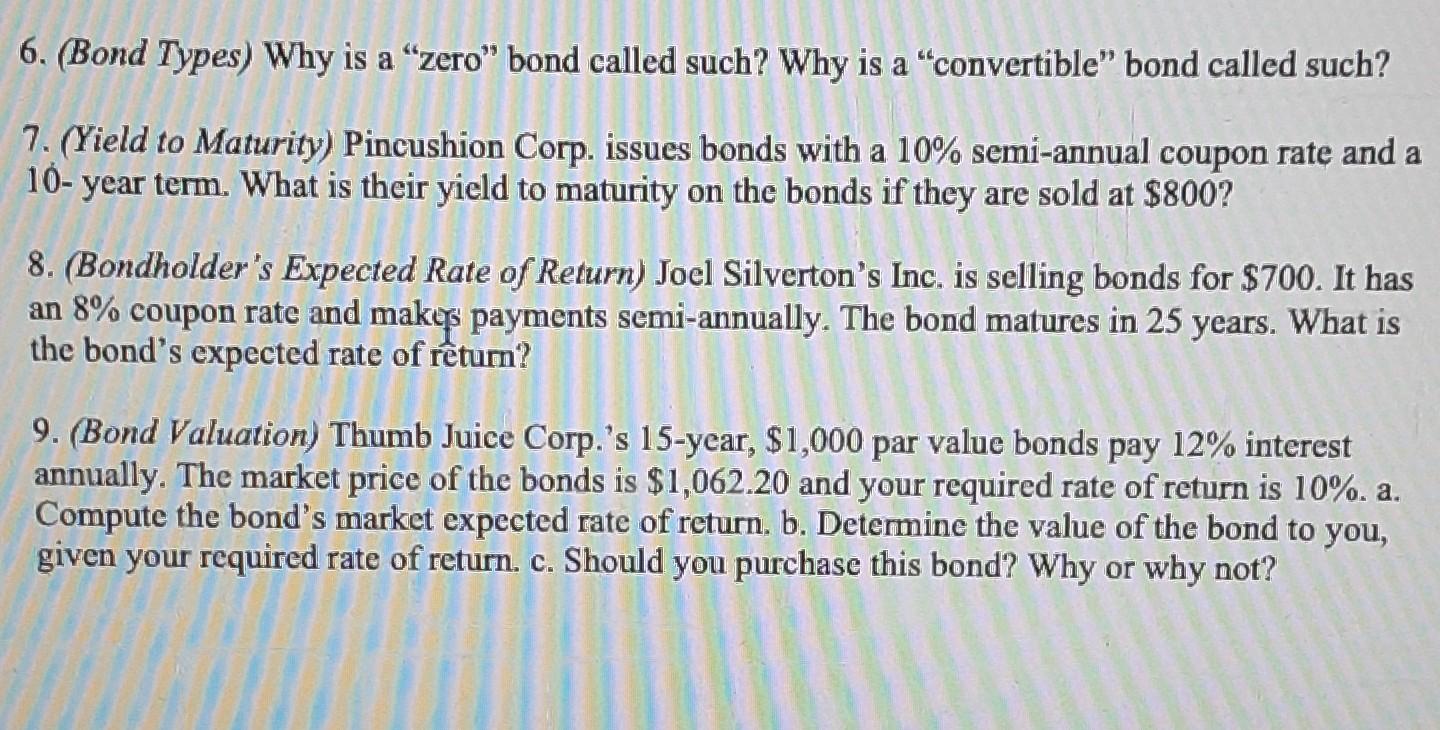

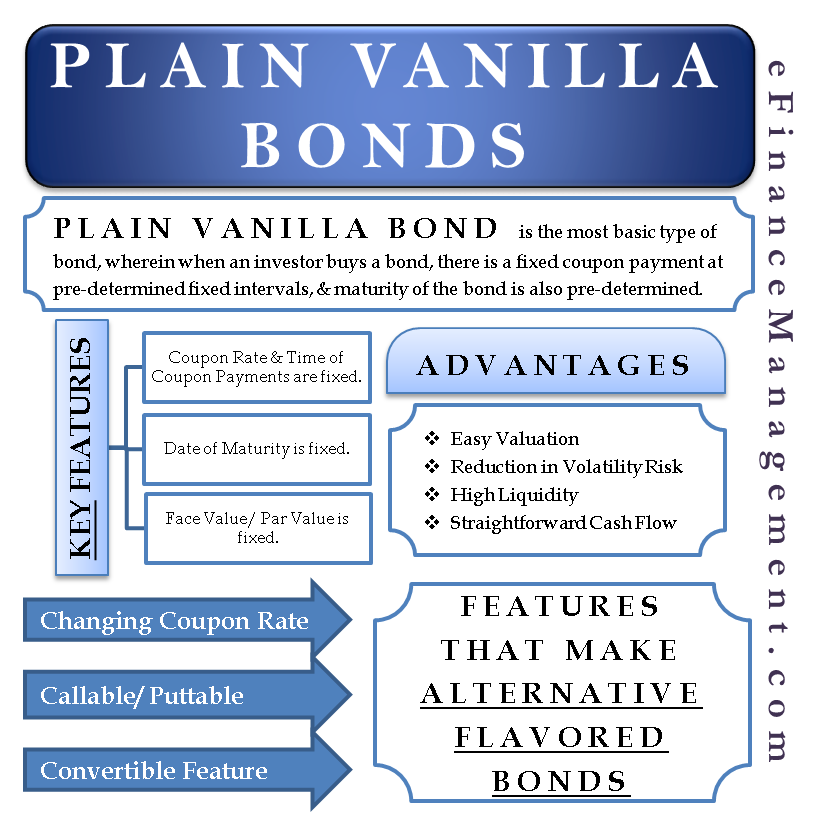

Autoblog Sitemap This page is for personal, non-commercial use. You may order presentation ready copies to distribute to your colleagues, customers, or clients, by visiting https ... Bond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ...

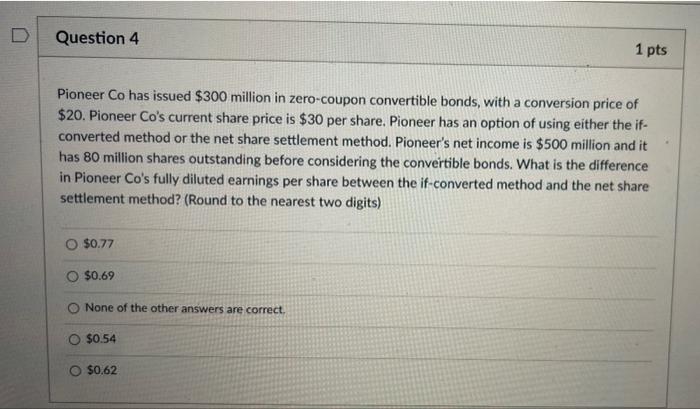

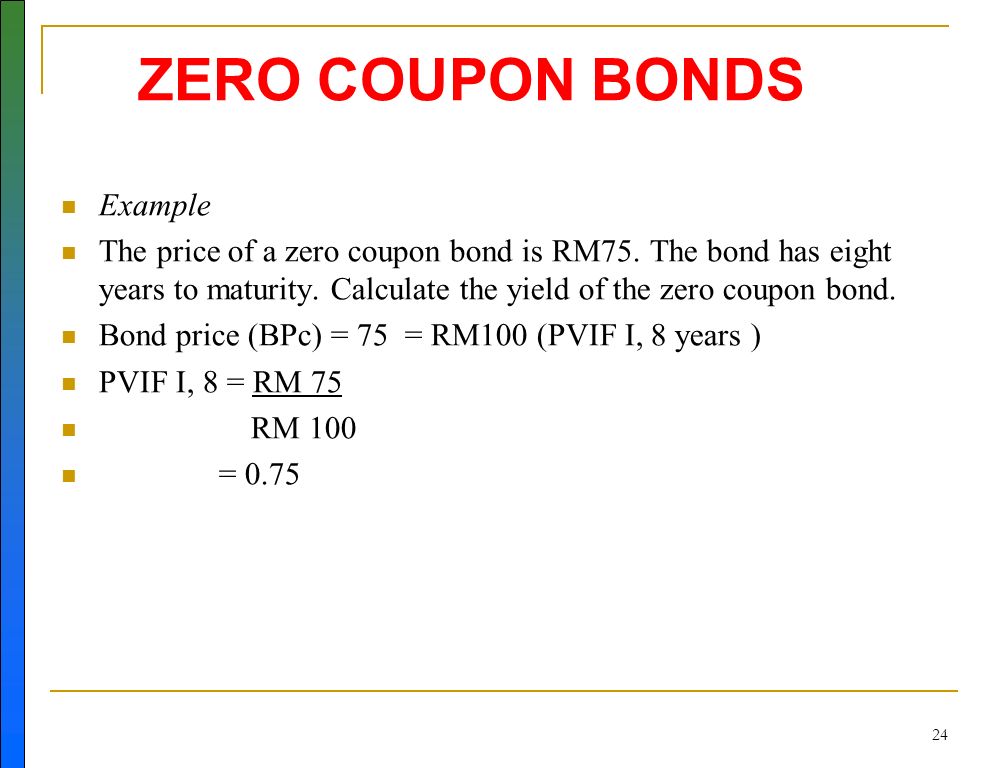

What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

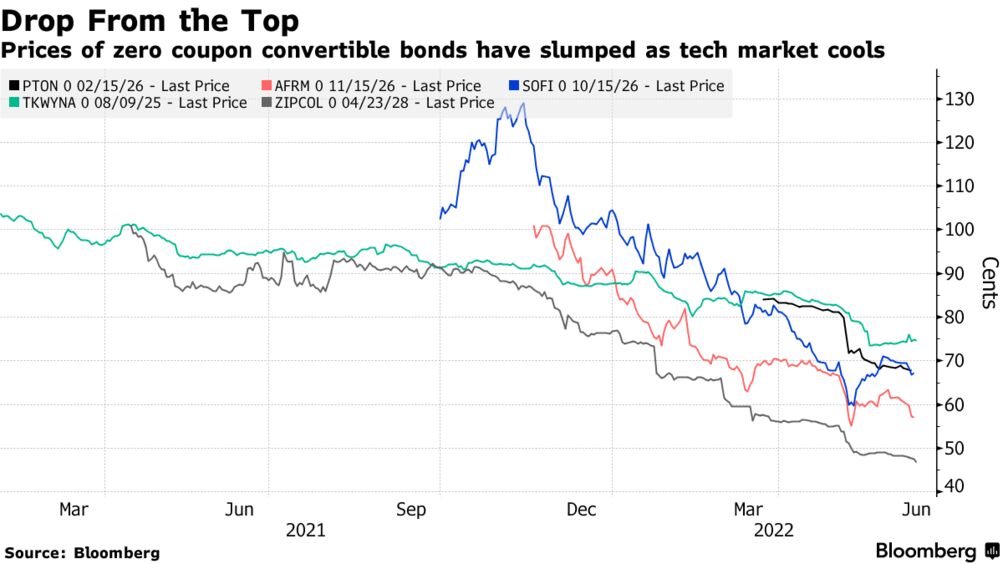

Zero coupon convertible bond

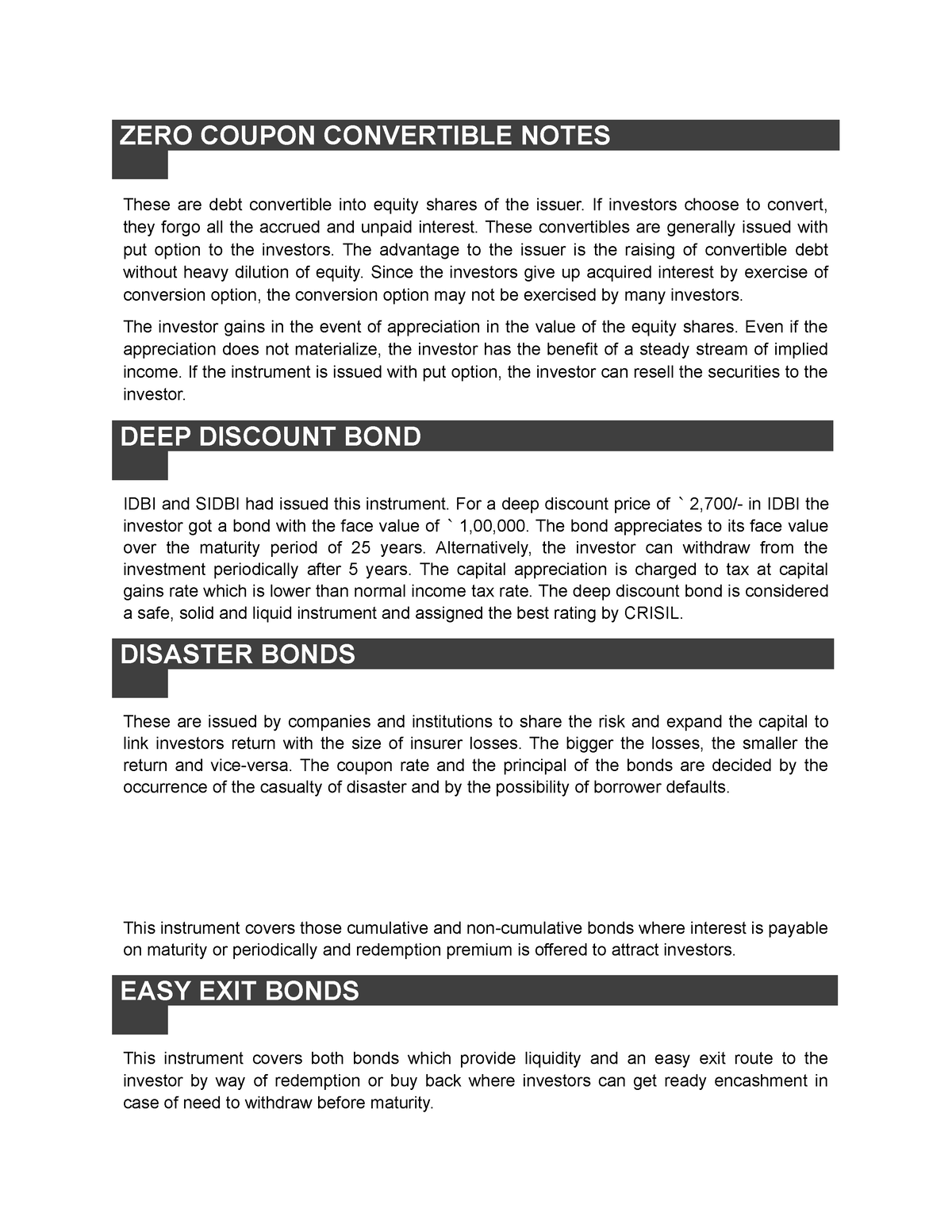

Dirty price - Wikipedia When bond prices are quoted on a Bloomberg Terminal, Reuters or FactSet they are quoted using the clean price. Bond pricing. Bonds, as well as a variety of other fixed income securities, provide for coupon payments to be made to bond holders on a fixed schedule. The dirty price of a bond will decrease on the days coupons are paid, resulting in a saw-tooth pattern for the bond value. … Bond convexity - Wikipedia In finance, bond convexity is a measure of the non-linear relationship of bond prices to changes in interest rates, the second derivative of the price of the bond with respect to interest rates (duration is the first derivative). In general, the higher the duration, the more sensitive the bond price is to the change in interest rates. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

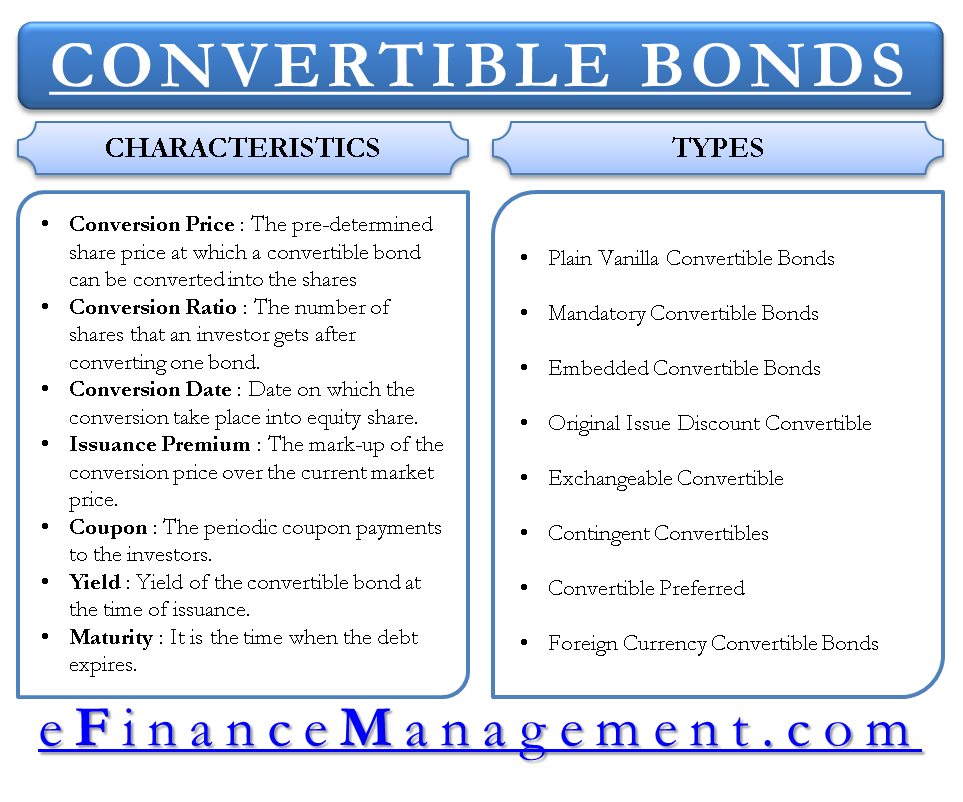

Zero coupon convertible bond. What is the difference between a zero-coupon bond and a ... Aug 31, 2020 · A zero-coupon convertible is a fixed income instrument that combines a zero-coupon bond and a convertible bond. more. Term to Maturity Definition. Zero Coupon Bonds: Know tax rules when such a bond is held ... Sep 22, 2022 · In bond terms, coupon rate means the rate of interest offered on a bond. As the coupon rate of a zero coupon bond is zero per cent, people investing in such bonds don’t get regular interest, but ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Bond convexity - Wikipedia In finance, bond convexity is a measure of the non-linear relationship of bond prices to changes in interest rates, the second derivative of the price of the bond with respect to interest rates (duration is the first derivative). In general, the higher the duration, the more sensitive the bond price is to the change in interest rates.

Dirty price - Wikipedia When bond prices are quoted on a Bloomberg Terminal, Reuters or FactSet they are quoted using the clean price. Bond pricing. Bonds, as well as a variety of other fixed income securities, provide for coupon payments to be made to bond holders on a fixed schedule. The dirty price of a bond will decrease on the days coupons are paid, resulting in a saw-tooth pattern for the bond value. …

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/14-Figure6-1.png)

/GettyImages-1169665828-e5e668e6aa454b60b5d06e110711eff3.jpg)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/7-Figure1-1.png)

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/10-Figure3-1.png)

Post a Comment for "44 zero coupon convertible bond"