42 zero coupon bond accrued interest

How to Calculate Yield to Maturity of a Zero-Coupon Bond The IRS mandates a zero-coupon bondholder owes income tax that has accrued each year, even though the bondholder does not actually receive the cash until maturity. This is called imputed interest . Zero-coupon bonds often mature in ten years or more, so they can be long-term investments. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The IRS mandates a zero-coupon bondholder owes income tax that has accrued each year, even though the bondholder does not actually receive the cash until maturity. 1 This is called imputed interest...

How to Calculate Yield to Maturity of a Zero-Coupon Bond The IRS mandates a zero-coupon bondholder owes income tax that has accrued each year, even though the bondholder does not actually receive the cash until maturity. This is called imputed interest . Zero-coupon bonds often mature in ten years or more, so they can be long-term investments.

Zero coupon bond accrued interest

Chile Government Bonds - Yields Curve The Chile 10Y Government Bond has a 6.750% yield. 10 Years vs 2 Years bond spread is -302 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 10.75% (last modification in September 2022). The Chile credit rating is A, according to Standard & Poor's agency. Eurodollar Futures Pricing and the Forward Rate Market - CME Group Assume that in December 2017, a June 2017 Eurodollar futures is priced at 99.10. This price reflects the market's perception that by the June 2017 expiration, three-month ICE LIBOR rates will be .90% (IMM Price convention= 100 - 99.10 = .90%). Eurodollars are really a forward-forward market and their prices are closely linked to the implied ... Track the Latest Updates on Debt Restructurings Across China Real Estate Creditors will also receive zero coupon bonds (ZCBs) with the principal equal to the accrued and unpaid interest of their existing notes, calculated at an annual rate of 2.5% Additional ZCBs may be issued to cover accrued and unpaid interest when New Bond 2 is converted to equity or, if New Bond 1 and New Bond 3 are redeemed before maturity.

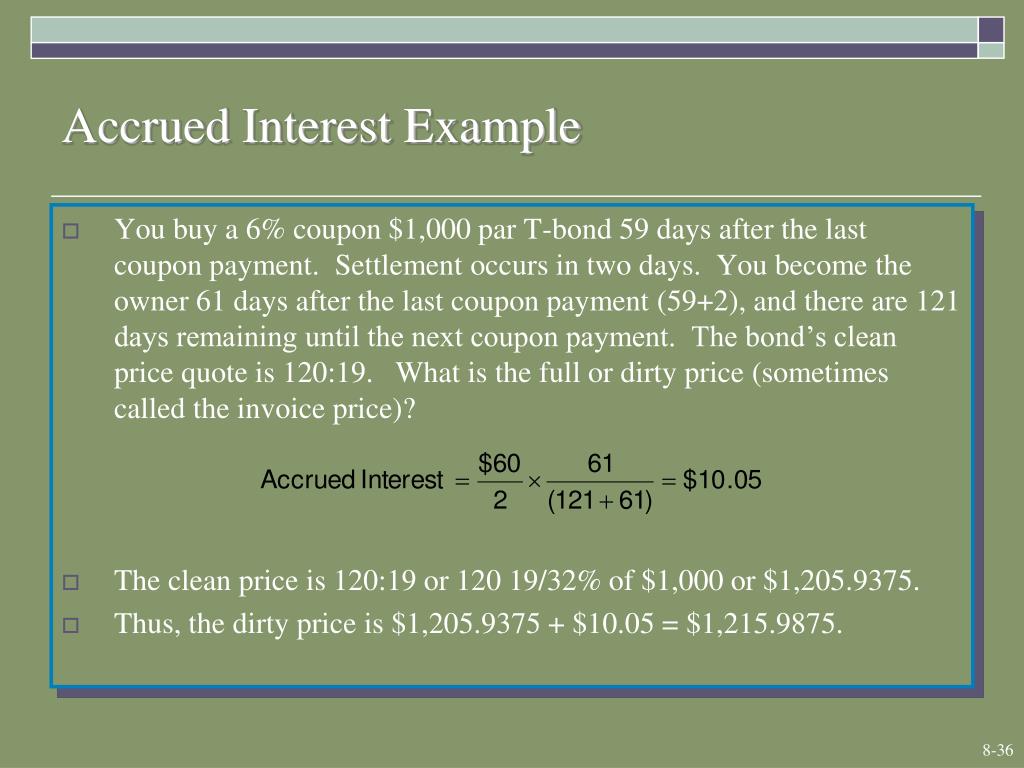

Zero coupon bond accrued interest. What Is a Zero-Coupon Bond? - The Motley Fool Say you want to purchase a bond with a face value of $10,000, 10 years to maturity, and 5% imputed interest. To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon... 797669VZ8: San Francis Use our tools and research to aid in your municipal bond decision making. ... Accrued Interest: Definition, Formula, and Example. ... Zero Coupon Muni Bonds - What You Need to Know. Municipal Bond Analysis: 6 Bond Market Indicators. View Less Bonds by State. Alabama Alaska ICE BofA US High Yield Index Option-Adjusted Spread - FRED Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets), 144a securities and pay-in-kind securities, including toggle notes, qualify for inclusion in the Index. Callable perpetual securities qualify provided they are at least one year from the first call date. en.wikipedia.org › wiki › Dirty_priceDirty price - Wikipedia To avoid the impact of the next coupon payment on the price of a bond, this cash flow is excluded from the price of the bond and is called the accrued interest. In finance , the dirty price is the price of a bond including any interest that has accrued since issue of the most recent coupon payment.

Guggenheim Select Quality Municipal Portfolio Series 1 Accrued Interest : $0.92: Principal Amount of Bonds * $787.47: Average Maturity: 14.1 Years: Estimated Annual Income: $29.9800: CUSIPs. Cash: 40167W229: Fee/Cash: 40167W237 . Deposit Information. ... • Certain bonds included in the Trust are original issue discount bonds or "zero coupon" bonds, as noted in "Trust Portfolio." ... How To Invest In Treasury Bills - Forbes Advisor Since they offer such short maturities, T-Bills don't offer interest payment coupons. Instead, they're called "zero-coupon bonds," meaning that they're sold at a discount and the difference between... The Discounted Cash Flows Model - BrainMass Coupon Bearing Bonds vs. Zero Coupon Bonds. Dan is considering whether to issue coupon bearing bonds or zero coupon bonds. The YTM on either bond issue will be 7.5%. The coupon bond would have a 6.5% percent coupon rate. The company's tax rate is 35%. These are 20 year bonds. 2. How many of the coupon bonds must East Coast issue to raise the ... Key Features of Government Securities - NSE India Treasury bills have maturity of 91 days, 182 days and 365 days Government bonds and State Development Loans pay interest every six months Treasury bills are zero coupon bonds. They are issued by discount and redeemed at face value Advantages of investing in G-sec, SDL and T-bill Safety: Being Sovereign security, no default risk

dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: ICE BofA Euro High Yield Index Option-Adjusted Spread Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and euro domestic markets), 144a securities and pay-in-kind securities, including toggle notes, qualify for inclusion in the Index. ... CMBS and CMOs), accrued interest is calculated assuming next-day settlement. Accrued interest for U.S. mortgage ... Current Rates | Edward Jones 5.25%. $10,000,000 and over. 5.00%. Rates effective as of September 22, 2022 . The margin interest rate is variable and is established based on the higher of a base rate of 4.00% or the current prime rate. Our Personal Line of Credit is a margin loan and is available only on certain types of accounts. senior loan vs mezzanine loan - spawallah.com best la girl contour shade; furniture warehouse sales los angeles; electric metal nibbler; jason industrial california; king farm condos for rent; i heart revolution heartbreakers daydream eyeshadow palette

ICE BofA US Corporate Index Option-Adjusted Spread Each security must have greater than 1 year of remaining maturity, a fixed coupon schedule, and a minimum amount outstanding of $250 million. Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US

Interest rate converter - AbhaajDenbhi Calculate accumulated depreciation. To determine the quarterly interest rate for a simple annual interest rate divide the annual rate by 4. 1 0032581365. He would simply be charged the interest rate twice once at the end of each year. Range of interest rates above and below the rate set above that you desire to.

Invesco | Product Detail | Long Term Investment Grade Trust Accrued Interest Est. Daily Rate of Accrual 4: $11.53000 $0.10821: ... such as the inability of the issuer or an insurer to pay the principal of or interest on a bond when due, volatile interest rates, early call provisions and changes to the tax status of the bonds. ... -Zero Coupon (%) (as of 09/21/2022) Sep 15, 2034 Next Call Date (as of 09 ...

LiveLive Market Watch - Bonds Trade In Capital Market, NSE India The bonds are traded & settled on Dirty Price i.e. including accrued interest. YOU ARE ON THE NEW NSE WEBSITE, ACCESS THE OLD WEBSITE ON THE URL www1.nseindia.com. Normal Market is Open-165.85 (-0.96%) Current Trading Date - 26-Sep-2022. Currency Market is Open. Current Trading Date - 26-Sep-2022 ...

NJ Division of Taxation - NJ Income Tax - Exempt (Nontaxable ... - State Interest and capital gains from obligations of the State of New Jersey or any of its political subdivisions or from direct federal obligations, such as U.S. Savings Bonds and U.S. Treasury Bills, Bonds, and Notes. For more information on exempt (nontaxable) income, see the section on income in the tax return instructions.

Glossary of Investment Terms - TTSE Accrued Interest; Admission to dealing; Agency Orders; Allotment; American Option; Amortization; Arbitrage; ... Yankee Bond; Yellow Knight; Yield; Zero Coupon Bond; Equities View latest activity. Bonds View latest activity. Mutual Funds ... Bonds. Activity for 23-Sep-2022. Symbol Open Close Change Volume; No Trade Activity.

How to Calculate Yield to Maturity of a Zero-Coupon Bond The IRS mandates a zero-coupon bondholder owes income tax that has accrued each year, even though the bondholder does not actually receive the cash until maturity. This is called imputed interest. Zero-coupon bonds often mature in ten years or more, so they can be long-term investments.

› zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

› articles › investingHow to Calculate PV of a Different Bond Type With Excel Feb 20, 2022 · Since the last coupon was issued, there have been 119 days of accrued interest. Thus the accrued interest = 5 x (119 ÷ (365 ÷ 2) ) = 3.2603. The Bottom Line

› bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

Investing in Bonds Online in India | HDFC Securities ZERO-COUPON BONDS These investment bonds are issued at a discount, but redeemed at the principal amount. G-SEC BONDS These are issued by the government and are one of the safest types of bonds to invest in. CORPORATE BONDS These types of bonds are simple bonds, wherein a company borrows and pays interest at regular intervals.

ICE BofA US High Yield Index Option-Adjusted Spread 2020-05-03. The ICE BofA Option-Adjusted Spreads (OASs) are the calculated spreads between a computed OAS index of all bonds in a given rating category and a spot Treasury curve. An OAS index is constructed using each constituent bond's OAS, weighted by market capitalization. The ICE BofA High Yield Master II OAS uses an index of bonds that are ...

› Pages › InterestInterest - Pennsylvania Department of Revenue The tax-exempt portion of the original issue discount bond with respect to a stripped coupon or stripped bond is the excess of the stated redemption price at maturity (or in the case of a coupon, the amount payable on the due date of the coupon), over an issue price that would produce a yield to maturity as of the purchase date equal to the ...

› terms › bWhat Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

r/bonds - zero coupon tbills. I am new to tbills, I have started buying ... 6.3K subscribers in the bonds community. The biggest community on Reddit related to bonds. ... I have started buying tbills but have been choosing zero coupon. Is there an advantage to buying non-0 coupon tbills, comments sorted by Best Top New Controversial Q&A Add a Comment . ... r/bonds • Accrued Interest. r/bonds ...

How to Invest in U.S. Saving Bonds | The Motley Fool As of August 2021, Series EE bonds pay an annual interest rate of 0.10%, which is added to the bond's value on a monthly basis. If the bonds are used for education, the accrued interest won't be...

Invesco | Product Detail | Insured Income Trust Investments in bonds or fixed-income securities may provide income for you to use now, to reinvest, or to put aside for the future. ... Accrued Interest Est. Daily Rate of Accrual 4: $1.38000 $0.08101: Beginning Interest Date ... -Zero Coupon (%) (as of 09/23/2022) Oct 24, 2022 Next Call Date (as of 09/23/2022) ...

GPW Benchmark - Index factsheet TBSP.Index is a total return index which includes the bond price performance, accrued interest, and revenue from reinvested coupons. The index portfolio comprises zero coupon bonds and fixed rate bonds denominated in Polish zlotys. The index is calculated on the basis of bond prices set on TBSP fixing sessions.

Track the Latest Updates on Debt Restructurings Across China Real Estate Creditors will also receive zero coupon bonds (ZCBs) with the principal equal to the accrued and unpaid interest of their existing notes, calculated at an annual rate of 2.5% Additional ZCBs may be issued to cover accrued and unpaid interest when New Bond 2 is converted to equity or, if New Bond 1 and New Bond 3 are redeemed before maturity.

Eurodollar Futures Pricing and the Forward Rate Market - CME Group Assume that in December 2017, a June 2017 Eurodollar futures is priced at 99.10. This price reflects the market's perception that by the June 2017 expiration, three-month ICE LIBOR rates will be .90% (IMM Price convention= 100 - 99.10 = .90%). Eurodollars are really a forward-forward market and their prices are closely linked to the implied ...

Chile Government Bonds - Yields Curve The Chile 10Y Government Bond has a 6.750% yield. 10 Years vs 2 Years bond spread is -302 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 10.75% (last modification in September 2022). The Chile credit rating is A, according to Standard & Poor's agency.

Post a Comment for "42 zero coupon bond accrued interest"