41 coupon rate of bond calculator

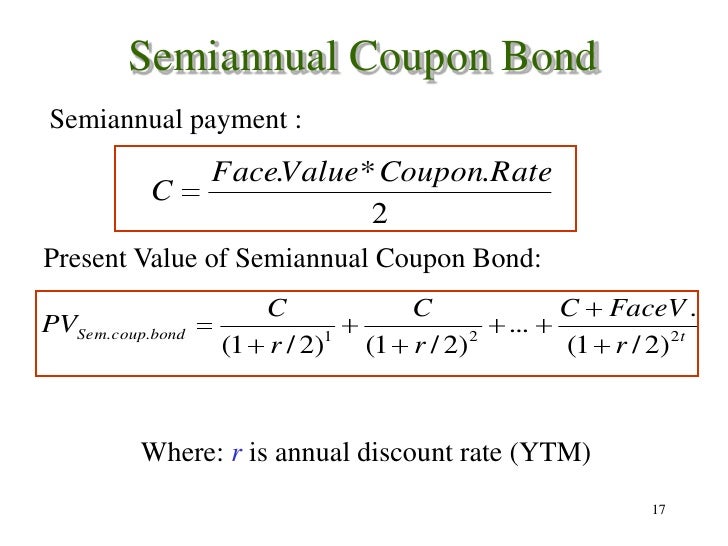

What Is Coupon Rate and How Do You Calculate It? Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100. $100 / $1,000 = 0.10. The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Financial Calculators Compound Interest Calculator. Return On Investment (ROI) Calculator. IRR NPV Calculator. Bond Calculator. Tax Equivalent Yield Calculator. Rule of 72 Calculator. College Savings Calculator. Investment Income Calculator. Mutual Fund Fee Calculator.

Coupon rate of bond calculator

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Interest is compounded semi-annually throughout the duration, or at the end of each fraction of a half-year for any fractional years ... SEBI Investor | Bond Calculator Bond Yield; Future Value (Compound Interest) EMI Calculator; Present Value; Rate of Return; Annuity; Retirement Bond Calculator (P. Peterson, FSU) The purpose of this calculator is to provide calculations and details for bond valuation problems. It is assumed that all bonds pay interest semi-annually. Future versions of this calculator will allow for different interest frequency. ... Coupon Rate: Face Value: Maturity Yield: Calculate. Bond Value. BOND VALUE:

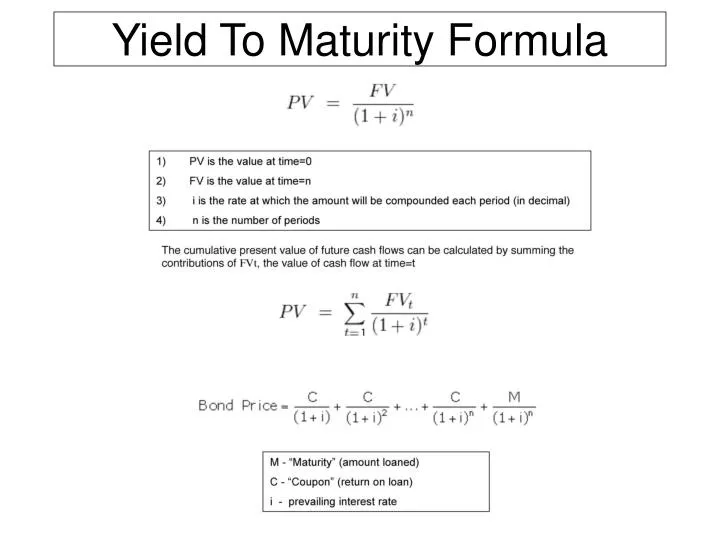

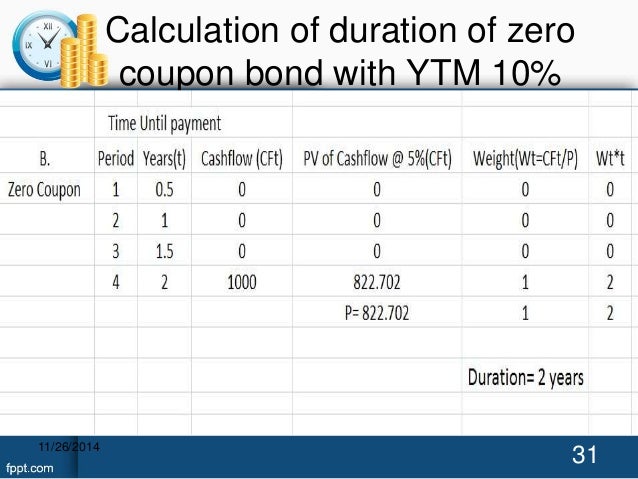

Coupon rate of bond calculator. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter If there is no coupon bond, we can also calculate the duration by using the formula mentioned under: Macaulay Duration = 1PV (T×PVT). PV = PVT = Face Value (1+r) T Therefore: Macaulay Duration = 1PV (T×PV) = T Here: D = Macaulay duration of the bond T = Periods up to the maturity i = the ith time period C = payment of the coupon Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond; For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000; Coupon Rate = 6%; Annual Coupon = $100,000 x 6% = $6,000 Bond Yield Calculator - Compute the Current Yield - DQYDJ On this page is a bond yield calculator to calculate the current yield of a bond. Enter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield. The tool will also compute yield to maturity, but see the YTM calculator for a better explanation plus the yield to maturity formula.

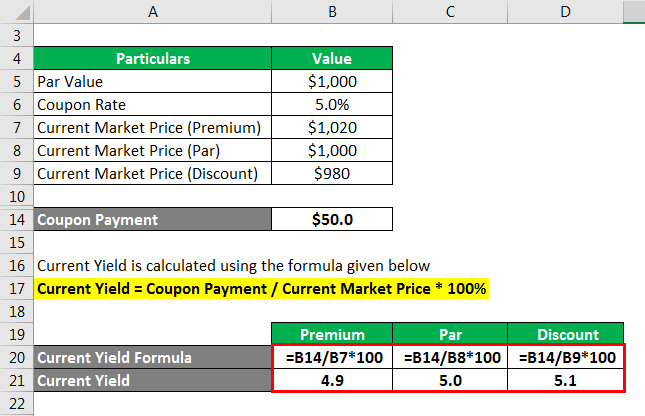

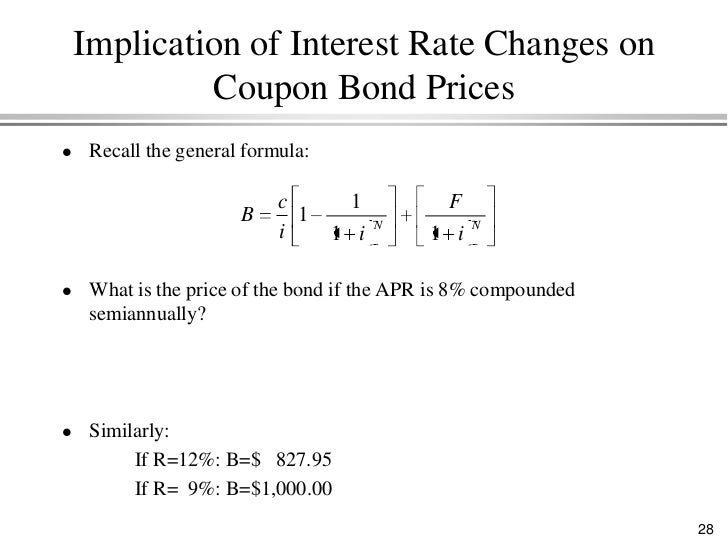

Bond Yield Calculator - CalculateStuff.com How to Calculate Bond Yield ; Annual Income = amount the investment returns in a year ; Current Market Price = amount the asset is worth at present day ; Bond ... Coupon Rate Calculator - EasyCalculation Here is a simple online calculator to calculate the coupon percentage rate using the face value and coupon payment value of bonds. The term coupon refers to ... Bond Yield Calculator Example of a calculation Let's assume a portfolio of bonds with the following characteristics: - Current clean price = $100,000 - Bonds nominal value = $65,000 - Coupon rate = 5% and figure out the results: Current bond yield = 3.25% Annual interest payment = $3,250.00 23 Feb, 2015 Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate As per the given question, Par value of bond = $1,000. Annual interest payment = 4 * Quarterly interest payment. = 4 * $15. = $60. Therefore, the coupon rate of the bond can be calculated using the above formula as, Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount.

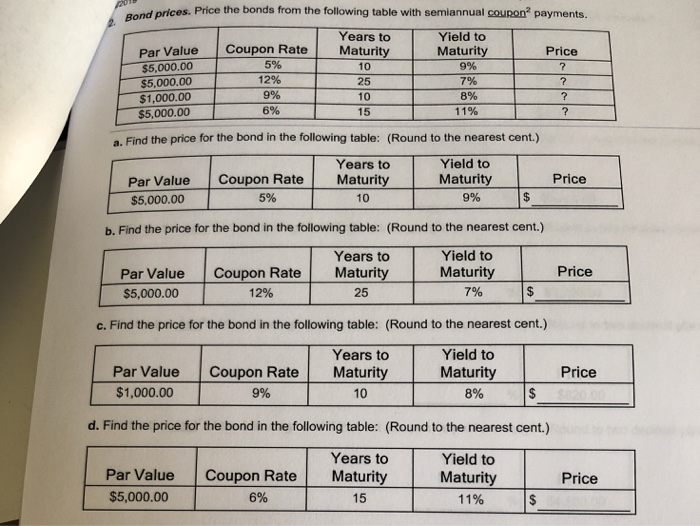

What Is a Coupon Rate? How To Calculate Them & What They're Used For Coupon rates can be determined by dividing the sum of the annual coupon payments by the actual bond's face value. However, this is not the same as the interest rate. For instance, a bond with a face value of $5,000 and a coupon of 10%, pays $500 every year. However, if you buy a bond above its face value, let's say at $7,000, you will get a ... Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

Coupon Payment Calculator Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.. You can quickly calculate the coupon payment for each payment period using the coupon payment formula:

Bond Price Calculator – Present Value of Future Cashflows Calculating Accumulated Interest — Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the ...

How to Calculate Coupon Rate in Excel (3 Ideal Examples) In this article, we will learn to calculate the coupon rate in Excel.In Microsoft Excel, we can use a basic formula to determine the coupon rate easily.Today, we will discuss 3 ideal examples to explain the coupon rate.Also, we will demonstrate the process to find the coupon bond price in Excel. So, without further delay, let's start the discussion.

Bond Calculator - Financial Calculators Bond Calculator Instruction. The Bond Calculator can be used to calculate Bond Price and to determine the Yield-to-Maturity and Yield-to-Call on Bonds Bond Price Field - The Price of the bond is calculated or entered in this field. Enter amount in negative value. Face Value Field - The Face Value or Principal of the bond is calculated or entered in this field.

How to Find Coupon Rate of a Bond on Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Bond Present Value Calculator - BuyUpside.com The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments)

Bond Price Calculator - Belonging Wealth Management The calculator will make the necessary adjustments to your annual coupon if you select this option. For instance, with the above mentioned $1,000 par bond paying a 6% coupon you would receive two payments of $30. Bond Calculator I want to solve for Price $ Coupon $ Face Value $ 3.750% yield to maturity 10 years to maturity Compounding Frequency

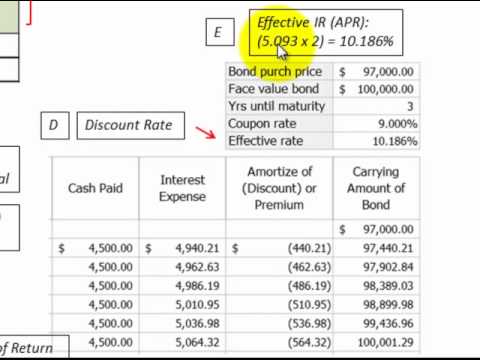

Bond Yield to Maturity (YTM) Calculator - DQYDJ We calculated the rate an investor would earn reinvesting every coupon payment at the current rate, then determining the present value of those cash flows. The summation looks like this: Price = Coupon Payment / ( 1 + rate) ^ 1 + Coupon Payment / ( 1 + rate) ^ 2 ... + Final Coupon Payment + Face Value / ( 1 + rate) ^ n

What Is the Coupon Rate of a Bond? - The Balance Coupon Rate Formula The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. Face Value $ Coupon Payment $ Submit Reset. Coupon Rate % Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value . Related Calculators Acid Test Ratio

How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Bond Calculator | Calculates Price or Yield Calculate either a bond's price or its yield-to-maturity plus over a dozen other attributes with this full-featured bond calculator. If you are considering investing in a bond, and the quoted price is $93.50, enter a "0" for yield-to-maturity. Also, enter the settlement date, maturity date, and coupon rate to calculate an accurate yield.

Bond Calculator (P. Peterson, FSU) The purpose of this calculator is to provide calculations and details for bond valuation problems. It is assumed that all bonds pay interest semi-annually. Future versions of this calculator will allow for different interest frequency. ... Coupon Rate: Face Value: Maturity Yield: Calculate. Bond Value. BOND VALUE:

SEBI Investor | Bond Calculator Bond Yield; Future Value (Compound Interest) EMI Calculator; Present Value; Rate of Return; Annuity; Retirement

Post a Comment for "41 coupon rate of bond calculator"