44 coupon rate 10 year treasury

10-Year T-Note Options Quotes - CME Group 10-Year T-Note Options - Quotes Venue: Auto-refresh is off There is currently no quotes data for this product. If you have any questions, please feel free to contact us. 10-Year Note Yield Curve Analytics Additional analytics for Treasury futures are available in our Treasury Analytics tool. View Yield calculation methodology here. CME FedWatch Fitted Yield on a 10 Year Zero Coupon Bond - St. Louis Fed Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-05-20 about 10-year, bonds, yield, interest rate, interest, rate, and USA. ... Kim and Wright (2005) produced this data by fitting a simple three-factor arbitrage-free term structure model to U.S. Treasury yields since 1990, in ...

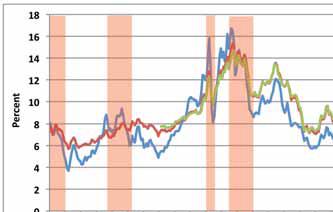

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... Categories > Money, Banking, & Finance > Interest Rates > Treasury Constant Maturity. Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity (DGS10) Download ... (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; ...

Coupon rate 10 year treasury

Kamakura Weekly Forecast, May 27, 2022: Peak In Treasury Forward Rates ... The peak in forward rates underlying the U.S. Treasury yield curve closed the week at 4.24%, up 0.10% from last week. In this week's forecast, the focus is on three elements of interest rate ... Yield Calculation for a 10-Year Treasury Note | Sapling Current yield simply is the annual interest amount that a bond pays divided by the current price of the bond. For example, if you buy a bond with a $1,000 face value and an interest rate -- also known as the coupon rate -- of three percent, you'll earn $30 per year in interest. Advertisement What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon rate 10 year treasury. How the 10-Year Treasury Note Guides All Other Interest Rates 0.06% on the one-month Treasury bill 0.06% on the three-month bill 0.73% on the two-year Treasury note 1.52% on the 10-year note 1.93% on the 30-year Treasury bond 12 Frequently Asked Questions (FAQs) How can I buy a 10-year Treasury note? You can buy Treasury notes on the TreasuryDirect website in $100 increments. Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .) What Is a 10-Year Treasury Note and How Does It Work? What Is the Current Yield on the 10-Year Treasury Note? As with interest rates, 10-year Treasury note yields are fluid and change often. As of early April 2020, the yield on a 10-year T-note was about 0.6%. The yield changes with the dynamics of the economic climate and is used as a benchmark for other interest rates. Building Wealth US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury, interest rates, bond rates, bond rate. Subscribe; Sign In; Menu Search. Financial Times. myFT. Search the FT Search Search the ... US 10 year Treasury. Yield 2.92; Today's Change 0.007 / 0.25%; 1 Year change +79.83%; Data delayed at least 20 minutes, as of Jun 03 2022 04:42 BST. ...

A new 10-year TIPS will be auctioned Thursday. Anyone interested? On the purchase price: The coupon rate will be 0.125% and the real yield will probably be around -1.03%, leaving a 1.15% shortfall to create the premium price. We've never had a 10-year TIPS with a negative yield so low. On Jan 21, the yield was -0.987%, resulting in an adjusted price of $111.64. US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2018-Present. TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2012 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present. TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present

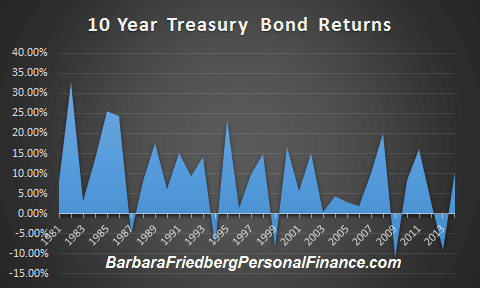

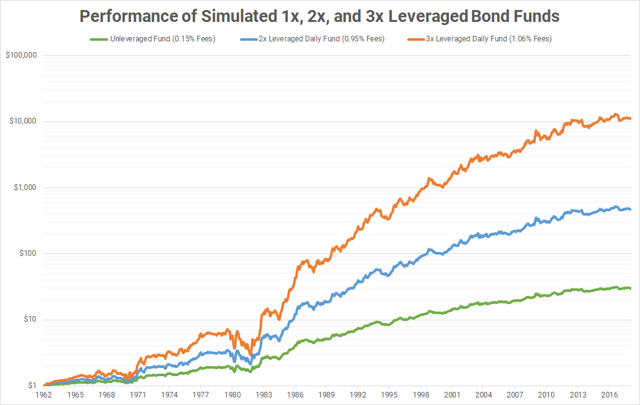

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ... TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch Coupon Rate 2.875% Maturity May 15, 2032 Performance Change in Basis Points Yield Curve - US Recent News MarketWatch Treasury yields hold steady as investors await Friday's official U.S. jobs... 10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of May 26, 2022 is 2.75%. Show Recessions Download Historical Data Export Image Interest Rates - U.S. Department of the Treasury The "Daily Treasury Long-Term Rates" are simply the arithmetic average of the daily closing bid yields on all outstanding fixed coupon bonds (i.e., inflation-indexed bonds are excluded) that are neither due nor callable for at least 10 years as of the date calculated.

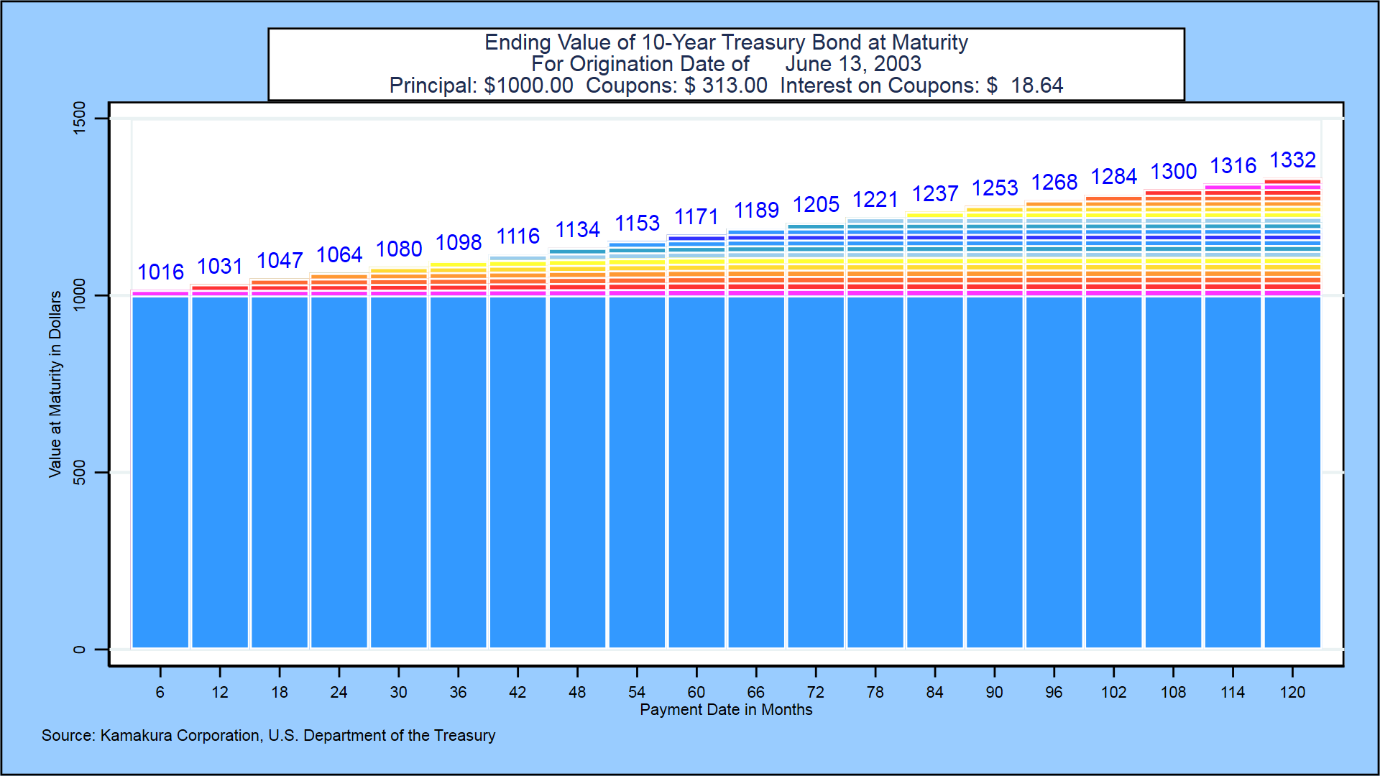

Treasury Return Calculator, With Coupon Reinvestment - DQYDJ A 10 Year Treasury note pays a coupon every 6 months. The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%.

10-Year Treasury Note Definition - Investopedia The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once...

How Is the Interest Rate on a Treasury Bond Determined? If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by the...

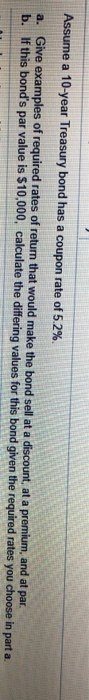

Solved 3. (20 points) Assume a 10-year Treasury bond has a - Chegg 3. (20 points) Assume a 10-year Treasury bond has a coupon rate of 2.2 % and par value of $1000. The selling price is $ 1170. A. Calculate and explain how much in dollars you will have on an annual basis, year by year, during years 1 through 10. Year 1; Year 2; Year 3..... Year 9 and Year 10 B. Calculate total dollar income received from this bod

US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Yield Open 2.911% Yield Day High 2.944% Yield Day Low 2.889% Yield Prev Close 2.931% Price 99.6406 Price Change +0.125 Price Change % +0.1289% Price Prev Close 99.5156 Price Day High 99.875 Price...

Ultra 10-Year U.S. Treasury Note Options Quotes - CME Group Ultra 10-Year Note Yield Curve Analytics ... Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. ... Analyze the all-in costs of managing interest rate exposure using listed futures versus over-the-counter (OTC) instruments like swaps. QuikStrike tools. Explore our ...

10 Year Treasury Rate - YCharts Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 2.92%, compared to 2.94% the previous market day and 1.59% last year. This is lower than the long term average of 4.28%. Stats

TMUBMUSD10Y | U.S. 10 Year Treasury Note Price & News - WSJ TMUBMUSD10Y | View the latest U.S. 10 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today's stock price from WSJ.

Individual - Treasury Bonds: Rates & Terms Premium (price above par) 30-year bond reopening. Issue Date: 9/15/2005. 3.99%. 4.25%. 104.511963. Above par price required to equate to 3.99% yield. Sometimes when you buy a bond, you are charged accrued interest, which is the interest the security earned in the current semiannual interest period before you took possession of the security.

10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes When setting the Federal Funds Rate, the Federal Reserve takes into account the current 10-year Treasury rate of return. The yield on the 10-Year Note is the most commonly used Risk-Free Rate for calculating a company's Weighted Average Cost of Capital (WACC) and performing Discounted Cash Flow (DCF) Analysis. Investing in Treasury Notes

Stock market results today: May jobs report, 10-year Treasury yield Employers added a robust 390,000 jobs, leaving the unemployment rate at a 50-year low of 3.6%. Average hourly earnings were up 5.2% compared to last May after they increased by $0.10, or 0.3%, to ...

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Yield Calculation for a 10-Year Treasury Note | Sapling Current yield simply is the annual interest amount that a bond pays divided by the current price of the bond. For example, if you buy a bond with a $1,000 face value and an interest rate -- also known as the coupon rate -- of three percent, you'll earn $30 per year in interest. Advertisement

Kamakura Weekly Forecast, May 27, 2022: Peak In Treasury Forward Rates ... The peak in forward rates underlying the U.S. Treasury yield curve closed the week at 4.24%, up 0.10% from last week. In this week's forecast, the focus is on three elements of interest rate ...

Post a Comment for "44 coupon rate 10 year treasury"