44 are zero coupon bonds taxable

Capital Gains Tax: Capital Gains Tax Rate in India (2022 ... STCG for a few assets are realized when the holding period is less than 12 months. These assets are: equity shares of a listed company, securities such as debentures and bonds, UTI units, and zero coupon bonds. STCG tax is also applicable on mutual funds. However, the holding period is different for equity based funds and debt funds. CBDT amends Income Tax rule 2F & rule 8B & release new ... CBDT amends Income Tax rule 2F, rule 8B and introduces new FORM NO. 5B - Application for notification of a zero coupon bond under clause (48) of section 2 of the Income-tax Act, 1961 and Form No. 5BA - Certificate of an accountant under sub-rule (6) of rule 8B vide Notification No. 28/2022-Income-Tax Dated: 6th April, 2022. MINISTRY OF FINANCE

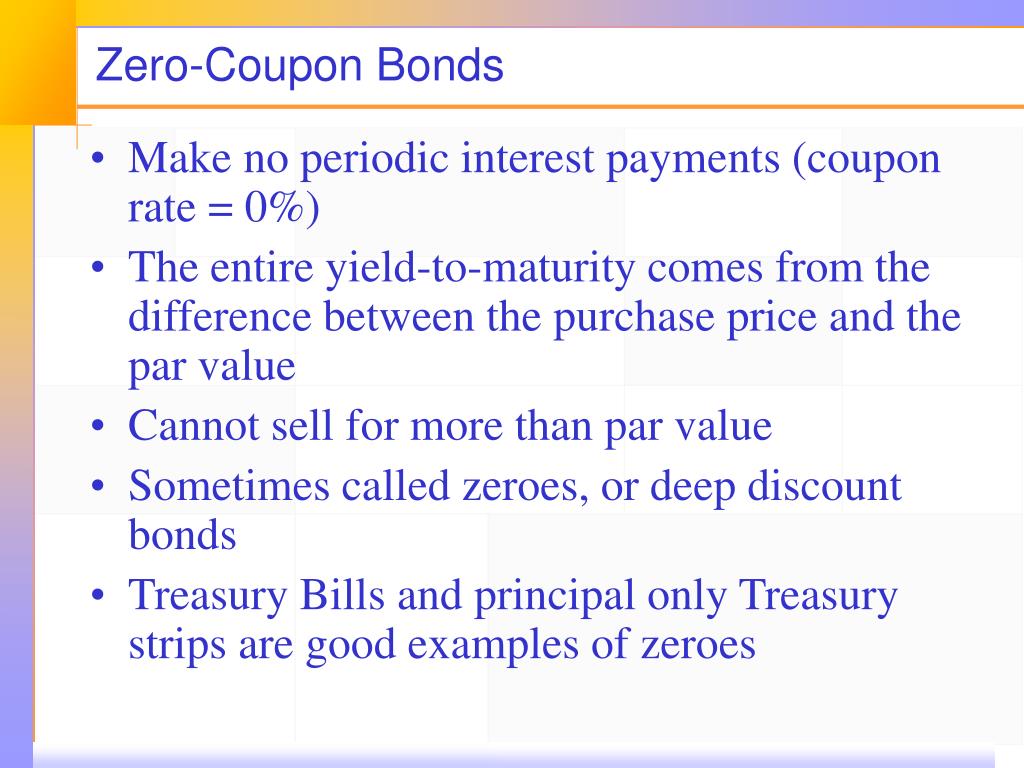

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

Are zero coupon bonds taxable

Tax Treatment of Bonds and How It Differs From Stocks Corporate bonds have no tax-free provisions. You will pay taxes on any earnings from these debt securities. However, if they're held in a retirement account like a 401 (k) or IRA, you won't owe tax on their earnings until you withdraw them in retirement. 3 Zero-coupon bonds have specific tax implications. Zero-Coupon CDs: What They Are And How They Work | Bankrate There are some tax implications you need to weigh, but zero-coupon CDs can earn higher yields than other types of certificates of deposit. Here's what you need to know about zero-coupon CDs. Tax Advantages of Series EE Savings Bonds Each savings bond is a zero-coupon bond. That means that you don't actually get checks in the mail for the interest you are owed like you would with a corporate bond or municipal bond . Instead, the value of the interest owed to you is added to the bond principal, and you get it when the bond matures, or you sell it back to the government ...

Are zero coupon bonds taxable. › terms › pPar Value Definition Feb 28, 2022 · Par: Short for "par value," par can refer to bonds , preferred stock , common stock or currencies , with different meanings depending on the context. Par most commonly refers to bonds, in which ... Zero-Coupon Bond Value | Formula, Example, Analysis ... As such, the bond is subject to income tax based in Internal Revenue Service (IRS) guidelines. This also means that while zero-coupon bonds require no coupon payments towards maturity, investors may still need to pay income taxes on all three levels - local, state and federal - based on the imputed or "phantom" interest accrued yearly. Advantages and Risks of Zero Coupon Treasury Bonds If issued by a government entity, the interest generated by a zero-coupon bond is often exempt from federal income tax, and usually from state and local income taxes too. Various local... Zero-Coupon Bond Definition - Investopedia The imputed interest on the bond is subject to income tax, according to the Internal Revenue Service (IRS). Therefore, although no coupon payments are made on zero-coupon bonds until maturity,...

Imputed Interest - FundsNet When it comes to zero coupon bonds, the imputed interest is based on the minimum interest rate, while the accrued interest based on the yield to maturity is used for below market loans. When the IRS computes for the imputed interest on Treasury Bonds, an accretive method is employed and has set federal tax rates at a minimum interest rate ... › wealth-management › adviceUS Treasury Securities - Taxable Bonds | Raymond James Like other zero-coupon bonds, bills are generally sold at a discount from par value. Notes are intermediate-term investments with maturities from two to 10 years at the time of issuance. These securities have a stated interest rate, make semi-annual payments, and may be purchased to meet future expenses or provide additional retirement income. Infrastructure Debt Funds - Tax Efficient Zero Coupon ... Background: On 6 April 2022, the Central Board of Direct Taxes has changed the Income-tax Rules, 1962, as amended ( IT Rules) to enable infrastructure debt funds as companies (" IDFs ") to issue... Taxable Bond Definition - Investopedia Examples of Taxable Bonds Consider a zero-coupon bond and Treasury bill, which do not pay interest for the duration of the bond's life. Instead, they are offered at discounts and redeemed at par...

NJ Division of Taxation - NJ Income Tax - Exempt ... Interest and capital gains from obligations of the State of New Jersey or any of its political subdivisions or from direct federal obligations, such as U.S. Savings Bonds and U.S. Treasury Bills, Bonds, and Notes. For more information on exempt (nontaxable) income, see the section on income in the tax return instructions. › markets › rates-bondsUnited States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. Investing in Zero Coupon in India - Free Income Tax ... They are only subject to capital gains tax. Tax on Gains: How is income from these bonds treated? As mentioned above, investors of notified zero coupon bonds issued by NABARD and REC are liable to pay only capital gains tax on maturity. Capital appreciation in such cases is the difference between the maturity price and purchase price of the bond. CBDT amends Rules to allow Infrastructure Debt Fund to ... The Central Board of Direct Taxes (CBDT) has substituted said sub-rule to allow Infrastructure Debt Fund to issue zero coupon bonds in accordance with Rule 8B. The Board has also amended Rule 8B, which provides guidelines for notification of zero-coupon bonds.

Understanding Zero Coupon Bonds - Part One You buy zero coupon bonds a deep discount to face value. You receive no interest until maturity; however, in most cases, you do owe taxes annually on the interest as it accrues. In Part Two In part two, we'll look more closely at the tax implications of zero coupon bonds and examine how you can use zeros to meet your financial goals.

What Are Treasury STRIPS? - Investment Guide - SmartAsset When stripping of Treasury bonds began, the government discouraged the practice due to concerns about lost tax revenues. However, in 1982 tax laws were modified to change tax treatment of zero-coupon bonds.The Treasury department then accepted stripping and also began issuing bonds electronically, without paper certificates or coupons.

Zero Coupon Bond Formula : Accounts and Finance Formulas / Its yield results from the difference ...

Calculating the cost basis on a tax free Zero Coupon Bond Calculating the cost basis on a tax free Zero Coupon Bond A tax free zero coupon bond is issued with a yield to maturity of 3.5%. After some time, an investor buys the bond at 50. ( 50 cents on the dollar ). When he buys the bond, the bond has a yield to maturity of 3.4%. After some time, he sells the bond for 80 cents on the dollar.

› corporate-bondsCorporate Bonds India- Invest in Corporate Sector Bonds Bonds having a credit rating of AAA to BBB are considered as Investment Grade Bond , others are considered as Non-investment Grade Bond. Coupon rate : Corporate bonds have higher coupon rates than G-secs. Normally, corporate bonds provide 7%(AAA rated) to 12%(A rated) coupons in the current year 2021. On the contrary, G-secs provide 6% coupon rate.

Calculating the cost basis on a tax free Zero Coupon Bond A tax free zero coupon bond is issued with a yield to maturity of 3.5%. After some time, an investor buys the bond at 50. ( 50 cents on the dollar ). When he buys the bond, the bond has a yield to maturity of 3.4%. After some time, he sells the bond for 80 cents on the dollar.

› ask › answersHow Are Municipal Bonds Taxed? - Investopedia Zero-coupon municipal bonds, which are bought at a discount because they do not make any interest or coupon payments, don't have to be taxed. In fact, most aren't. As long as you're investing in a...

How are Bonds Taxed Under the Income Tax Act? - Wint Wealth Zero-coupon bondholders are liable to only capital gain tax as they do not provide any interest income. However, these are issued at a discount. Hence, the difference is taxed as capital gain. 2. Market-Linked Bonds Market-linked bonds offer fixed interest, and the interest rates are linked to the index it is tracking.

What is Phantom Income? (with picture) Zero coupon bonds are a common cause of phantom income. They yield no interest to those who possess them, but, because they are sold at a discount, are technically still profitable to their owners and thus taxable.

Zero Coupon 2025 Fund | American Century Investments Each Zero Coupon fund invests in different maturities of these debt securities and has different interest rate risks. The fund can only offer a relatively predictable return if held to maturity. Investment in zero-coupon securities is subject to greater price risk than interest-paying securities of similar maturity.

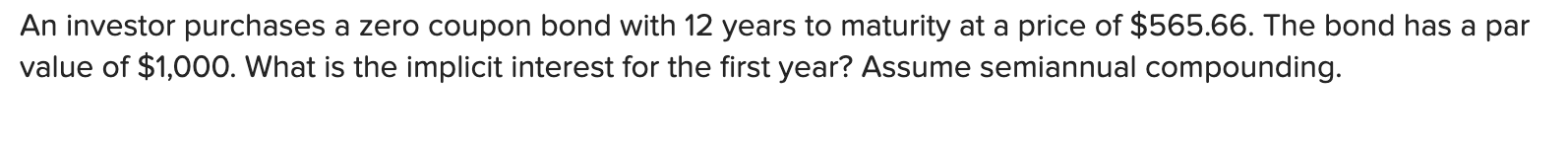

Bonds and stocks practice - 1 A pure discount(or zero-coupon government bond is issued today ...

Zero Coupon Bond Definition and Example | Investing Answers For tax purposes, the IRS maintains that the holder of a zero-coupon bond owes income tax on the interest that has accrued each year, even though the bondholder does not actually receive the cash until maturity.

united states - Can zero-coupon bonds go down in price? - Personal Finance & Money Stack Exchange

Letter Ruling 84-41: Zero Coupon Bonds Issued by Non ... Holders of either corporate or government bonds issued after July 1, 1982, other than tax-exempt government obligations under I.R.C. § 103, must include in federal gross income the sum of the daily portions of original issue discount determined for each day the bond is held during the taxable year.

How Are Corporate Bonds Taxed? - Investopedia They are exempt from federal income taxes, and if you buy them in the state where you live they are exempt from state and local taxes. 3 On the other hand, there are zero-coupon bonds that have tax...

Bonds can be taxable or tax-free — here's your guide to ... Zero-coupon bonds. Zero-coupon bonds are a special case. You might have to pay tax on their interest income — even though you don't actually receive any interest. With a zero-coupon bond, you buy the bond at a discount from its face value, don't receive interest payments during the bond's term, and are paid the bond's face amount when it matures.

Bonds can be taxable or tax-free — here's your guide ... Zero-coupon bonds are a special case. You might have to pay tax on their interest income — even though you don't actually receive any interest. With a zero-coupon bond, you buy the bond at a...

Post a Comment for "44 are zero coupon bonds taxable"